Trending post

SMBC Leads Investment Round as MODIFI Expands Its Global Reach and Reinvents Digital Solutions for SMEs

Amsterdam-based fintech company MODIFI, an industry leader in B2B Buy Now, Pay Later (BNPL) trade finance, has closed new funding in the amount of $15 million. The round was led by SMBC Asia Rising Fund, with existing investors like Maersk, IntesaSanPaolo, Heliad, and other leading global players round out the offering. Sumitomo Mitsui Banking Corporation-one of Japan’s largest financial institutions-and a major player in the Asia-Pacific (APAC) region-enter, providing both financial resources and alignment to push MODIFI forward in its ambitious objectives.

As part of the equity investment, MODIFI and SMBC entered into a Memorandum of Understanding, agreeing to collaborate in developing digital trade finance solutions for small and medium-sized enterprises (SMEs) in Asia. Such collaboration will enable both the companies to scale up their international trade operations to a far greater extent, taking advantage of innovation financial solutions and expertise.

Fast Track Global Expansion and SME Enablement

The newly invested capital will be instrumental in scaling MODIFI’s operations, especially in China and India, the two significant growth markets for which the company has already established a powerful presence. MODIFI’s platform provides SMEs with the critical liquidity and flexible payment terms that establish optimal cash flows, enable global reach, and help nullify historical financial barriers to international expansion.

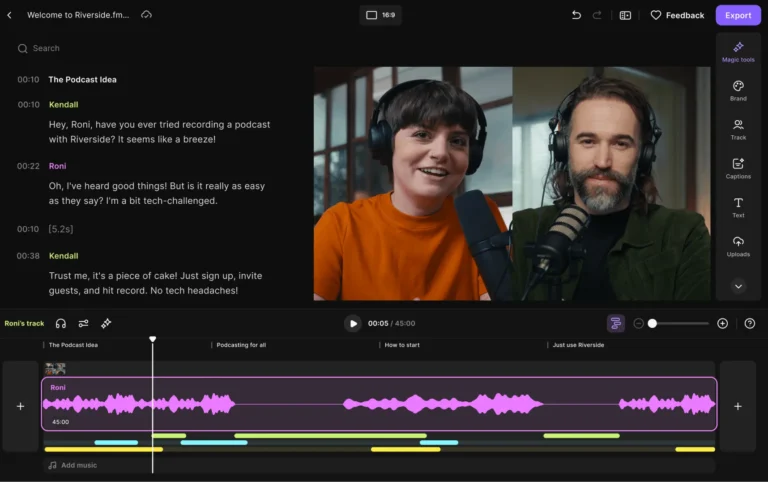

Launched in 2018 by the entrepreneurs who have grown the fintech firm BillPay, Sven Brauer, Jan Wehrs, and Nelson Holzner, MODIFI has rapidly established itself as one of the leading companies in the trade finance space. The company relies on technological innovation to provide short-term, flexible, and secure financial options for businesses to make faster, smoother, and more effective cross-border transactions.

MODIFI is unlocking vital working capital for SMEs through an instant approval for trade finance that its large global network has achieved. In addition, the platform also integrates advanced risk management tools that protect businesses from defaults and fraud by buyers, therefore giving better security and confidence in the global markets.

A New Era in Trade Finance

To date, MODIFI has helped facilitate over $3 billion in cross-border transactions across more than 1,800 companies. So far, the platform has seen incredible success and adoption. By combining advanced risk management capabilities with seamless payment processes, MODIFI is setting new standards on how businesses can engage in cross-border commerce. The company’s tools are designed to cater to all business sizes so as to enable them in scaling and competing in this increasingly globalized market.

This investment underlines the trust in our capacity to redefine the future of global trade finance,” said Nelson Holzner, founder and CEO of MODIFI. “As the form of international trade evolves, MODIFI places itself, ready to offer innovative solutions that will be at the service of expanding businesses across borders.”.

He concludes that the mission for the company is still clear: enabling SMEs to take their place in the global market with fast, flexible, and secure financial solutions. The new funding will support MODIFI in further developing and scaling up its platform for the growing demand for trade finance in the digital age.

Partnership with SMBC

For SMBC, this round would prove essential strategic value. Keiji Matsunaga, the General Manager of the Digital Strategy Department at SMBC expressed excitement at partnering with MODIFI. “MODIFI is uniquely positioned to revolutionize cross-border supply chain finance for the digital age, allowing SMEs to scale their export businesses with greater agility and financial flexibility.”. Our partnership will break through the traditional barriers that exist in international trade; therefore, it will create new opportunities for growth for our clients.

Through the partnership, MODIFI and SMBC look forward to combining their strengths to drive digital solutions in trade finance for SMEs, helping businesses expand their reach on a global scale and compete on the world stage. This latest round of investment and strengthened partnership will increase the MODIFI’s position in reshaping and further disrupting the global trade finance market in new ways, helping businesses better access liquidity and protection to grow internationally.

In this dynamic global trade environment, MODIFI is differentiated in its approach to making trade finance truly important to enable SME success on the world stage.

Pingback: Validation Cloud Secures $10M In Funding To Expand AI