Latest post

Berlin-based WealthTech startup NAO has successfully raised €3.4 million in a seed funding round, marking a significant step forward in its mission to democratize alternative investments. This funding round attracted participation from a range of private investors, family offices, and venture capital firms, including FinTech veteran Jakob Schreyer and Zeitgeist X Ventures, both of whom had supported the company in its earlier stages. With this fresh capital, NAO aims to further expand its innovative platform, enabling retail investors to access high-value investment opportunities traditionally reserved for institutional players and the financially elite.

NAO’s Mission: Democratizing Wealth Building

Founded in 2022 by Robin Binder, Philipp Nowakowski, and Amel Hasanovic, NAO has developed a unique, app-based platform to offer the ordinary investor the opportunity to invest in alternative asset classes like private equity, infrastructure, hedge funds, and so on. These investment classes are usually reserved for rich individuals or institutional investors and can now be accessed even by retail investors with only €1,000.

With this vision, NAO aims to level the financial playing field, granting more people the opportunity to diversify their portfolios and gain access to long-term wealth-building options. Since its launch mid-2023, thousands of users have been drawn to the platform, where the average investment per customer is around €10,000. This is one of the indicators of demand for more accessible and transparent investment opportunities.

Strategic Partnerships and Expansion

Other than user growth, NAO has also made a series of key partnerships with some of the leading banks and asset managers. Some of them are Baader Bank, Chartered Investments, FERI, UniCredit, UBS, and Vontobel. Such agreements will enable NAO to offer alternative investment opportunities of wider scope to the users of its platform.

Also read London-Based Nscale Raises $155M to Expand Sustainable AI Cloud Infrastructure

NAO has already started making its presence felt in Austria, reaching further beyond the German borders for enhanced penetration within the European market. The 3.4 million Euros funding will further enable NAO to maintain this upward momentum by inviting more premier asset managers into its folds, entering newer markets and enhancing its technology to upscale its operations accordingly.

Also read New Zealand-based Grw AI Secures $2.4M to Transform Sales Coaching with AI

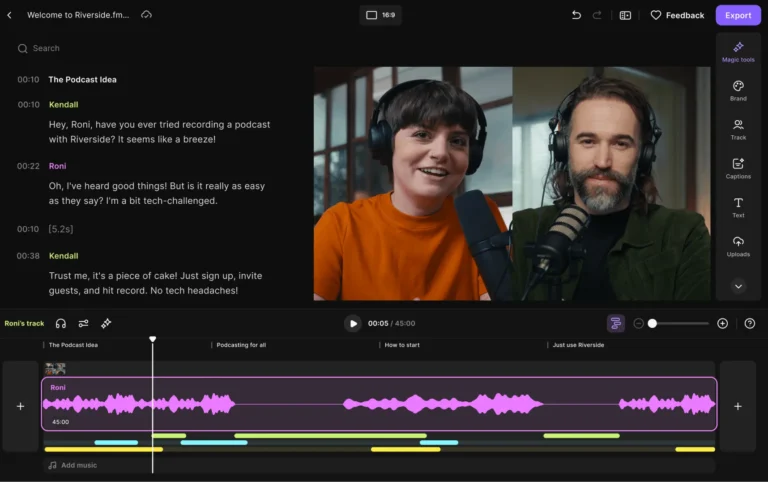

NAO’s platform offers an intuitive, user-friendly interface to streamline the process of co-investing in alternative assets. Traditional alternative investments have often been seen as illiquid and inaccessible to most investors. NAO seeks to change that by introducing technology that makes these markets more liquid and more widely available to everyday investors. NAO will thus simplify the process and reduce barriers to entry, which have prevented many from accessing private equity and other high-value asset classes by creating a “broker” for alternative investments.

Robin Binder, founder and CEO of NAO, said the idea is to make alternative investments as accessible and straightforward as buying stocks or ETFs. Everyone should be able to invest in private equity and other alternative assets as effortlessly as they do in stocks or ETFs. By securing this new funding we’re able to expand on the types of partners we partner with, grow our base of international customers, and we’re able to help more people unlock the wealth hidden in markets that we never thought were accessible, through our technology,” he added.

The Growth in WealthTech

NAO’s success forms part of a larger trend within the WealthTech sector where technology is revolutionizing how wealth management and investment opportunities are delivered. The sector is growing rapidly, driven by innovations that enable individuals to access investment opportunities once reserved for the wealthy. With the latest funding, NAO is well placed to continue leading the charge in this space, attracting more users and fostering the growth of alternative investments for retail investors.

This vision of the startup has already achieved industry recognition, including winning at FinTech Germany Award. Such an award reflects an increasingly important role of democratizing finance and wealth-building tools for a wider audience.

The Road Ahead: International Expansion and Technological Advancements

NAO will have several key strategic objectives for the future. It is set to deepen its partnerships with the leading global financial institutions to broaden its range of investment products and enhance the features of its platform. The company will also look at other European markets besides its current operations in Austria, which will further broaden its international footprint.

Another key focus will be the continued improvement of its scalability and functionality. With more customers seeking accessible alternatives to traditional stock market investments, the company looks to make alternative assets such as private equity more liquid, reducing the traditionally long wait times for investors to cash out.