Latest post

London-based analytics firm 9fin announced its Series B funding round at $50 million led by Highland Europe. Continued involvement from existing investors like Spark Capital, Redalpine, Seedcamp, 500 Startups, and Ilavska Vuillermoz Capital complemented Highland Europe’s lead. It will enable 9fin to scale its algorithmic technology, grow the analysts’ team, and step up its expansion into the US market.

Established in 2018, 9fin has been an important participant in transforming debt markets through AI-powered analytics for professionals operating in global credit markets. The clients of the company range from investment banks and distressed debt advisors to private equity firms, credit fund managers, and law firms. Together, 9fin’s client base controls over $17 trillion in assets, which represents a considerable market for its platform.

Addressing the Challenges in Debt Markets

9fin’s mission is to modernize debt markets, which are still relying on outdated systems and slow, opaque processes. As Steven Hunter, co-founder and CEO of 9fin, said, “Debt markets are the biggest overlooked asset class in the world, and yet they still rely on technology and information sources straight out of the 1980s—opaque, slow, and messy.” The stock market, on the other hand, is dominated by electronic trading and fast information. News in the debt space takes up to 30 minutes to hit the market, and data is usually incomplete or hard to interpret.This inefficiency has led 9fin to utilize its expertise in AI and machine learning to centralize and modernize the tools required for debt analysis. The company’s platform seeks to provide debt professionals with faster, more accurate intelligence by centralizing data and simplifying the process of evaluating credit risks and investment opportunities. This approach enables users to outperform their peers, win business, and save time by accessing key insights in one comprehensive platform.

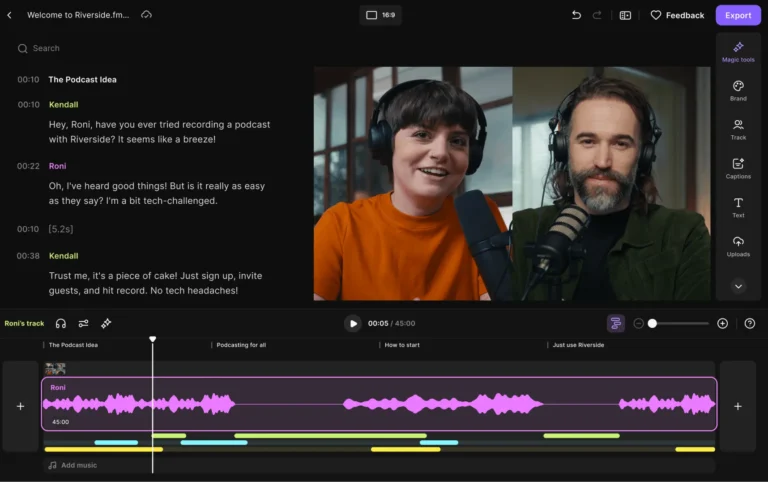

AI-Powered Debt Market Analytics Platform

The heart of 9fin’s solution is its AI-powered data and analytics platform that applies advanced algorithms to deliver deep analysis of debt and credit markets. This tool aggregates all the necessary resources that professionals require to analyze credits or secure mandates, thus providing smarter and timelier insights than traditional methods. The platform helps debt analysts, investors, and other market participants make faster data-driven decisions.Applying machine learning to vast datasets, 9fin’s technology automatically analyzes data to quickly identify trends, assess credit risks, and predict possible market shifts. The AI approach is much faster and more accurate than manual, old processes still in use in the debt markets. For professionals in the sector, real-time insights driven by AI allow them to respond better to changes in the market and be positioned ahead of competitors.

Expanding into the US and Scaling the Team

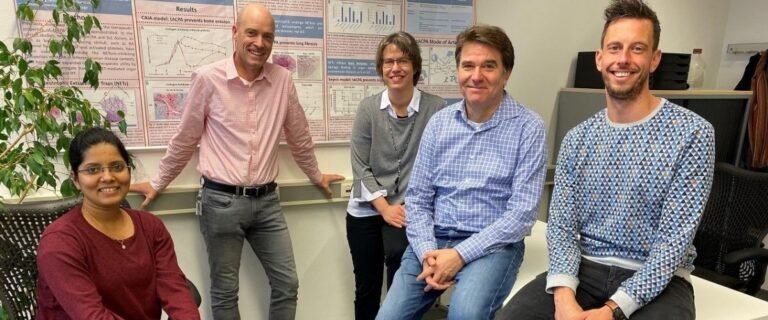

The Series B funding will not only enhance the technology of 9fin but also fuel its expansion in the United States. With this capital, the company plans to enhance its presence in the US market, where debt market analytics is becoming increasingly vital for investment decisions. Moreover, 9fin intends to grow its team, particularly analytics staff, to support an expanding client base and to continue innovating its platform.Hunter commented on the future of the company, saying, “I’m really proud of the product, team, and company culture we’ve built so far at 9fin, and we’re just getting started. There’s a huge opportunity to build the #1 global provider of debt market analytics, and bring debt markets into the AI age.”

9fin is scaling up its technology and driving the broader adoption within the global debt market, staying true to the ambitious vision. The company is intent on becoming the go-to destination for professionals within the credit markets- a more efficient and reliable alternative to data solutions of today.